Supplement Plan Comparison

Medicare Supplement plans, also known as Medigap, are provided by private insurance companies and they help to offset the out-of-pocket costs associated with Original Medicare, such as copayments, coinsurance, and emergency care costs outside the country.

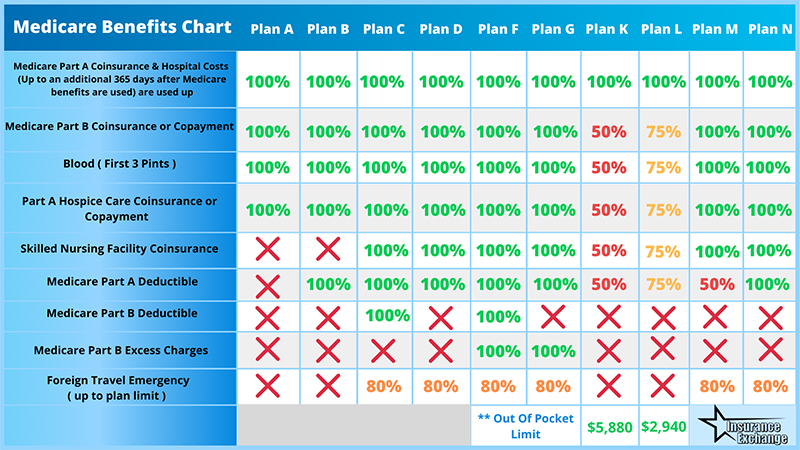

When you buy a Medicare Supplement plan, you can get extra help with Medicare Part A and Part B deductibles, copayments, and coinsurance costs. Supplement plans are standardized in every state where they’re available and are labeled from Plan A to Plan N. Medigap policies offer various benefits and have different plan premiums. In this article, we’ll make a comparison of the ten Medicare Supplement plans.

Medigap Plan Comparison

Medigap Plan A: Medicare Supplement plan A provides some basic benefits. It covers the cost of Part A coinsurance, hospice care coinsurance, and hospital costs. Medicare Supplement Plan A also covers the coinsurance, copayments, and the first three pints of blood for a blood transfusion under Medicare Part B.

Medigap Plan B: Medicare Supplement Plan B covers the same benefits Medicare Supplement Plan A covers, as well as the hospital costs, coinsurance costs, and deductibles for Medicare Part A.

Medigap Plan C: Medigap Plan C pays for all the out-of-pocket costs from Medicare Part A and Part B. This Supplement plan also covers 80% of the charges for foreign travel emergencies. However, there’s no provision for the excess charges for Part B under Medigap Plan C.

Medigap Plan D: Medicare Supplement Plan D covers almost all the out-of-pocket costs from Medicare Part A and Part B. However, the exception is the deductible and excess charges for Medicare Part B. Medigap Plan D also covers 80% of the charges for foreign travel emergencies.

Medigap Plan F: Medicare Supplement Plan F is the most comprehensive Medigap plan. It’s also one of the most popular Medicare Supplement plans due to the fact that it covers all of the remaining out-of-pocket costs from Original Medicare. Also, Medigap Plan F covers the deductible for Medicare Part B and 80% of the foreign travel emergency expenses.

Medigap Plan G: Medicare Supplement Plan G covers almost all of the out-of-pocket costs left from Medicare Part A and Part B. Plan G also covers 80% of the charges for foreign travel emergencies. However, this Supplement plan doesn’t cover the deductibles from Medicare Part B.

Medigap Plan K: Medigap Plan K covers all of the Medicare Part A coinsurance and hospital costs. Plan K also covers 50% of the Part A coinsurance costs and copays for hospice care, the coinsurance for skilled nursing facility care, Part A deductibles, 50% of the Part B coinsurance and copayment costs, and the first three pints of blood during a blood transfusion.

Medigap Plan L: Medicare Supplement Plan L is a cost-sharing policy. It covers all the coinsurance costs and hospital costs for Medicare Part A. The plan also covers 75% of the Part A deductible, Part A hospice care coinsurance, and the skilled nursing facility coinsurance. Plus, Plan L covers 75% of the copayments and coinsurance for Part B, and the first three pints of blood for blood transfusions.

Medigap Plan M: Plan M is another cost-sharing policy. It covers Part A hospice care coinsurance costs, the coinsurance for skilled nursing facility care, and 50% of the deductible for Medicare Part A. Medigap Plan M also covers the copayments and coinsurance left from Medicare Part B, the first three pints of blood for medical procedures, and 80% of the foreign travel emergency expenses.

Medigap Plan N: Except for the Part B excess charges and deductible ($203 in 2021), Medigap Plan N covers all the out-of-pocket costs left from Medicare Part A and Part B. It’s one of the most comprehensive and popular Medicare Supplement plans available.

Reach out for more info about Medicare Supplement health insurance plans in Sarasota/Manatee Counties. We’ll give you quotes and recommendations according to your needs and budget.